The PassCash Physical Visa Debit Card is coming soon!

Send, Spend and Shop

Send, Spend and Shop

The PassCash Physical Visa Debit Card is coming soon!

Pre-order your card now and be among the first to experience financial freedom with PassCash!

Crypto Wallets: What You Need to Know

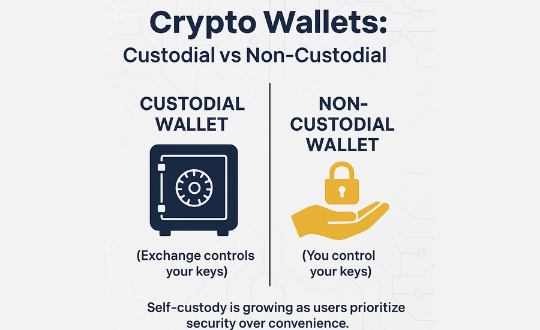

Choosing the right wallet is key to managing digital assets. This article explains the difference between custodial and non-custodial wallets, highlights how wallets store keys (not coins), and why self-custody is gaining traction as exchange risks grow.

How Crypto Wallets Secure Blockchain Access

Custodial vs Non-Custodial Wallets

Wallets Hold Keys, Not Coins

Why More Users Are Choosing Self-Custody

A crypto wallet is an application that provides an interface to access and make transactions with a crypto address, much like an email client provides an interface to send and receive emails. A wallet is always non-custodial, meaning that it contains the private key (a kind of cryptographic password) that gives control over the crypto address and its content. By holding a private key, the user is the only person who has access to their funds and can control them. Nobody else can seize or block these funds, as long as the private key remains secret.

We talk about custodial platforms (not wallets) like Coinbase or Binance, where users have to first deposit funds before trading. The funds are therefore under the custody of the platform, which holds them on behalf of the user, similar to a bank. The problem is that such platforms can get hacked or go bankrupt (like FTX), resulting in the loss of funds for the users.

Bitcoin and cryptocurrencies were precisely created to allow people to opt out of the banking system and to have total control over their money, without involving third parties and having to trust them. Using custodial platforms therefore defeats the whole purpose of cryptocurrencies for the sake of convenience, and should thus be avoided.

Yann Gerardi, Head of Marketing, Mt Pelerin

As crypto becomes more mainstream, one of the important things every user must understand is how to store their digital assets safely. This is where crypto wallets come in. A crypto wallet doesn't actually store your coins--instead, it stores the private keys that grant access to your cryptocurrencies on the blockchain. If you lose these keys, you lose access to your funds, making wallet choice a critical decision.

There are two main types of crypto wallets: custodial and non-custodial. Each comes with its own benefits and responsibilities.

What is a Custodial Wallet?

Third-Party Control with Easy Access

In a custodial wallet, a third party--usually a crypto exchange like BuyUcoin, or Coinbase--holds your private keys. These wallets are ideal for beginners because they're easy to use and provide built-in recovery options in case you lose your login credentials. You can also buy, sell, or trade crypto directly within the platform.

Pros and Cons

However, you're essentially trusting someone else with your assets. If the exchange gets hacked or goes offline, your funds could be at risk. Moreover, you don't technically "own" your crypto in this setup--because you don't hold the keys.

What is a Non-Custodial Wallet?

Full Ownership, Full Responsibility

Non-custodial wallets give you complete control. You hold your own private keys and manage your own security. Popular examples include MetaMask, Trust Wallet, and hardware wallets like Trezor.

Pros and Cons

These wallets offer greater privacy and eliminate third-party risk. But with this freedom comes responsibility. If you lose your keys or forget your recovery phrase, there's no way to get your crypto back.

Key Differences Between Custodial and Non-Custodial Wallets

The key differences come down to control and convenience. Custodial wallets are user-friendly and safer for beginners, but they require trust in a third party. Non-custodial wallets put you in full control but demand better security practices and technical know-how.

Which Wallet Should You Choose?

If you're just starting out, a custodial wallet can help you ease into the world of crypto. As you grow more confident, consider moving to a non-custodial option for better ownership and control. For large investments, a hardware wallet is a great choice for long-term security.

Final Thoughts

Understanding how these wallets work--and choosing the one that fits your needs--can make all the difference in your crypto journey. Always remember: Not your keys, not your coins.

Shashank Samdarshi, Business Marketer, BuyUcoin

A crypto wallet differs from a cash wallet in that it doesn't actually store your crypto. Instead, cryptocurrencies remain on the blockchain you're interacting with. Think of a crypto wallet more like a box that holds the keys to your assets.

Custodial wallets are managed by third parties, such as exchanges like Binance or Coinbase. These platforms hold the keys to your crypto and provide you with access to your funds.

In contrast, non-custodial wallets, like MetaMask or Rabby, give you full control. You hold the keys to your crypto, which means you're entirely responsible for managing and securing your assets.

Ade Molajo, Connecting top Web3 VCs to leading projects, Ecoforge

Custodial wallets (such as those provided by exchanges like Coinbase or Binance) are controlled by third parties that keep your private keys -- so they have entire access to your funds. Although easy for beginners, this carries counterparty risk: in 2022 alone, over $3.8 billion was lost to exchange hacks and insolvencies, according to Chainalysis data. Non-custodial wallets such as MetaMask or Ledger store the ownership of private keys on the user side and avoid dependence on intermediaries. This is in keeping with crypto's core ethos of decentralization, but comes with a lot more personal responsibility -- lose your keys, lose everything; your funds are gone forever.

Custodial wallets offer speed and liquidity, which is part of why so many active traders use them despite the risks, from a trading perspective. Long-term investors and those who are security-conscious should use non-custodial options, ideally combined with cold storage for volume holdings. A new study from blockchain data analytics firm Glassnode suggests that the growing digital currency supply is being actively distributed among self-custodian holders. At KriminilTrading, we are in favor of a hybrid strategy: use custodial wallets for intraday movement, but withdraw your earnings to non-custodial wallets frequently. In crypto, your keys are your kingdom -- don't gamble.

Kevin Huffman, Day Trader| Finance& Investment Specialist/Advisor | Owner, Kriminil Trading